| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

miércoles, 15 de agosto de 2018

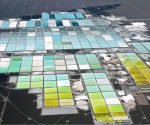

Lithium boom unlikely to disrupt potash market — analyst

Suscribirse a:

Enviar comentarios (Atom)

You have been invited to contribute to La Tota Tv

Hello, The purpose of this message is to inform you that La Tota TV has invited you to contribute to their blog "La Tota Tv"...

-

Having trouble viewing this email? View online Mining News Digest Friday 15 December 2017 Home Gold Coal Copper Iron O...

-

Having trouble viewing this email? View online Mining News Digest Thursday 23 November 2017 Home Gold Coal Copper Iron...

No hay comentarios:

Publicar un comentario